One of the most important things to grasp in hospitality is that price setup and operation are aligned to set resources with an anticipated level of occupancy.

However, unlike the retail sector, demand is latent. This means that if these unwanted offers are not manifested into the customers’ outlook, latent demand will never become an expressed demand. This estimation is thus conceptual and technical for data scientists.

One major distinction in hospitality analytics is between non-restricted demand and restricted demand. Non-restricted demand is the theoretical level of demand considering that price or availability or sales prohibit booking behavior by any means.

On the other hand, restricted demand is the observed demand. The customer is faced with the actual prices and availability conditions of that hotel. Estimation and analyses of those two yield powerful and complementary views on potential and realized revenue opportunities.

- Restricted demand and unrestricted demand

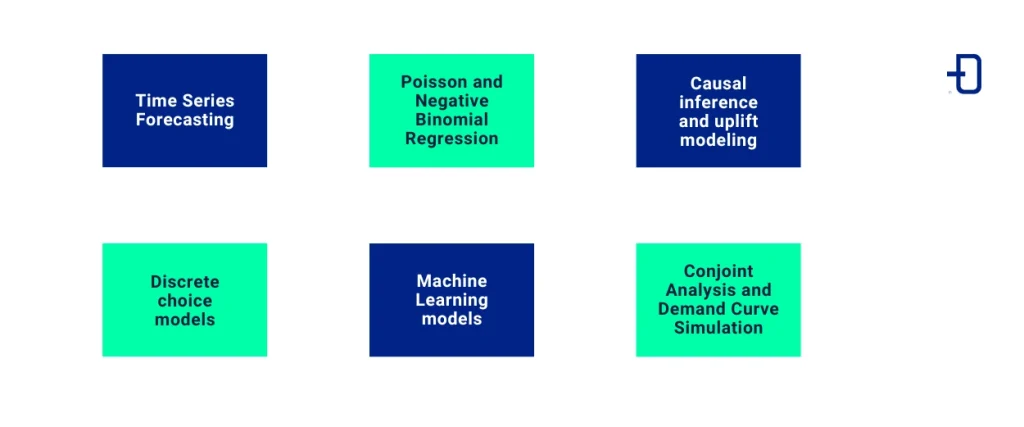

- Methods of Demand Estimation

- Time Series Forecasting (Univariate & Multivariate)

- Poisson and Negative Binomial Regression

- Causal inference and uplift modeling

- Discrete choice models: Multinomial logit, nested logit

- Machine Learning Models: Gradient Boosting, Random Forests, Neural Networks

- Conjoint Analysis and Demand Curve Simulation

- Conclusion

Restricted demand and unrestricted demand

Non-restricted demand is the true underlying interest in a service or product independent price or inventory constraints. For example, during a major conference in a city, there can be an unusually high demand for accommodation at a hotel situated centrally.

However, if the hotel imposes a rate of $600 per night and secures only 50 bookings, then the non-restricted demand might far exceed that: given that 150 people would have presumably tried to book at the hotel but were alienated somehow by being priced out.

On the other hand, restricted demand is formed by customer behavior under real-world constraints. It is the demand that appears in recorded historical data-bookings made against actual prices and actual availability. It reflects not just preference but also price sensitivity, booking friction, and inventory constraints.

Distinguishing that difference is crucial. If only restricted demand is taken into account, he or she might underestimate potential during very high-demand periods or overestimate potential during periods of a low-price promotion. Most data-driven pricing systems utilize restricted data, thereby failing to incorporate the invisible ceiling that non-restricted estimates can provide.

Methods of Demand Estimation

Time Series Forecasting (Univariate & Multivariate)

The classic time series approach, including models such as ARIMA, Exponential Smoothing, and Prophet, can be used to forecast room nights or the count of bookings. When they incorporate exogenous variables, such as weather, events, and holidays, they can either forecast restricted or non-restricted demand, depending on the specific context.

Pros:

- Easy to implement and interpret.

- It works well with short-term forecasting.

Cons:

- Models assume that historical patterns will repeat.

- Price effects are not disentangled unless modeled explicitly.

Poisson and Negative Binomial Regression

Regression for counts of events is appropriate when one models the number of bookings, especially when one has to consider the structure of variance (e.g., overdispersion in bookings).

Advantages:

- Agnostic about specification.

- Suitable for count data.

Disadvantages:

- Difficulty in generalizing to multivariate or hierarchical contexts.

- Maybe less-than-ideal in addressing temporal autocorrelation.

Causal inference and uplift modeling

To estimate restricted demand, one may analyze the data with propensity score matching, inverse probability weighting, or various models that measure treatment effects to isolate the impact of price or restrictions.

Advantages:

- Directly tackles the fundamental question of “What would demand have been at different prices?”

Disadvantages:

- It needs very strong assumptions about ignorability and about the existence of sufficient variation in historical pricing.

Discrete choice models: Multinomial logit, nested logit

Simulates the choice that a customer would make among multiple hotels or room types, based on utility functions that depend on price and attributes.

Advantages:

- The model captures price-elasticity directly.

- Models plausible customer choice behavior.

Disadvantages:

- Needs appropriate specification.

- Requires quite large datasets.

- Estimates may be computationally intensive.

Machine Learning Models: Gradient Boosting, Random Forests, Neural Networks

ML can take in dozens of features to predict bookings directly or predict the probability of booking at a given price. These predictions can be used to simulate scenarios under different prices and thus give estimates of restricted demand.

Advantages:

- Most accurate with sufficient amount of data.

- It can model complex nonlinear relationships.

Disadvantages:

- Less intuitive, may require the use of simulation methods for establishing causal effects of changes in price.

Conjoint Analysis and Demand Curve Simulation

In conjoint analysis, preferences of consumers are elicited directly in order to estimate the demand curve. The simulation from that transformation allows one to establish the price-demand relationship and changes in the demand with respect to price (classification into restricted and non-restricted).

Advantages:

- Directly models price sensitivity.

- Useful in case of insufficient historical data.

Disadvantages:

- Surveys may not exactly capture real-world behavior.

Conclusion

Predicting demand in the hospitality industry is as much about inference as it is about prediction. Differentiated between restricted and non-restricted demand is crucial for revenue management, pricing, and forecasting. Restricted demand is what was; non-restricted demand is what could have been.” A full demand model strategy requires both.

Standard time series and count-process models are a reasonable starting point, but a more nuanced understanding requires estimating the price effect in a potentially causal way, or at least one that is not dominated by regression-to-the-mean-type influences. Both approaches have trade-offs in terms of interpretability, accuracy, and data dependencies.

As a hospitality data scientist, your worth is not in predicting room nights, but also in knowing the opportunity that pricing and availability decisions expose (or hide). They only can optimize performance in a demand-sensitive, inventory-constrained environment by estimating both restricted and non-restricted demand.

If you found this article interesting, we encourage you to visit the Data Science category to see other posts similar to this one and to share it on networks. See you soon!