The Revenue Management (RM) departments of companies have the objective of maximising revenue (ideally it should be profit, but this is something we will talk about in another article) through optimal pricing management. There are many considerations that these teams have to take into account when making decisions. They must analyse factors such as demand, available stock, sensitivity to price changes in their market, competition and many others.

One pricing system that is obsolete today, but unfortunately still in use in many companies, is a static pricing system. This type of strategy consists of setting prices and leaving them stable for long periods of time, regardless of the evolution of the above-mentioned components that should be taken into account in order to achieve the objective of optimal pricing.

However, the challenge is not only to move away from a static pricing system to a dynamic pricing system, that is, a system that reacts quickly to changes in the context in order to take better advantage of market opportunities. The real challenge is to implement a dynamic pricing system in an optimal way.

The word ‘optimal’ is subtle but of great relevance, as optimal, to be precise, implies that there is no alternative pricing system that is capable of generating more revenue. And this is very difficult to achieve or even to know, since, without A/B testing, you cannot guarantee with absolute certainty that another unpublished pricing policy would have generated more revenue.

In this article, we will see how certain implementations of dynamic pricing systems do not guarantee revenue optimality. More specifically, we will look at the three most common implementations of dynamic pricing systems that lead us away from more revenue-optimal scenarios.

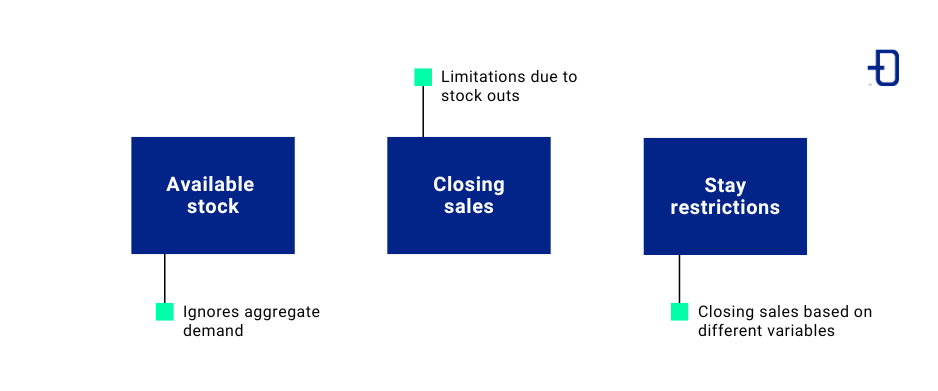

Pricing based on available stock

The simplest implementation of dynamic pricing is to increase prices as less stock is available. This methodology is especially common when the product has an expiration date, that is, after a certain day, consumption of the product is no longer possible. Common examples are a plane ticket, a hotel room reservation, a ticket to a music concert or food, among many others.

Given that when a product expires it can no longer be sold, the Revenue Management team increases prices as fewer units are available. In this way, sales increase from low prices at times of high stock.

This type of pricing has several disadvantages, but we will emphasise the two most important ones.

- There is no consideration of how much the customer is willing to pay. Let’s take an example. Imagine that customers who buy flight tickets well in advance are highly inelastic, in other words, price changes have very little impact on units sold. Failure to consider this scenario means that we are not aware that increasing the price to this type of customer is likely to lead to an increase in revenue, due to the small loss of sales that such a change would entail.

- Aggregate demand for the day is not being taken into account, where aggregate demand is understood as the sum of the demand for each of the day’s peak periods. Let’s go back to airline examples. Let’s assume a day of high demand in which the plane is filled at a price of €300 per ticket. In this context, selling the first seats at prices below €300 simply because we are well in advance of the day in question is inefficient. The optimum would be to stop selling to those customers who are not willing to pay €300, since in later advance, customers who agree with this price will convert until the plane is full. In other words, a pricing system based on available stock does not correctly take into account aggregate demand, which is what really matters for optimal pricing.

Closing sales

Closing sales are another tool that Revenue Management teams have to apply their strategies. They consist of stopping the sale of a given product, mainly due to stock-outs.

Although it is common to see dynamic pricing systems complemented with the possibility of close-outs, an optimal dynamic pricing system is not compatible with this tool, as it may make it impossible to convert customers who are willing to pay a high price for the product.

For this reason, its use should only be considered in a context of demand prediction and conversion failures. In case of having a good artificial intelligence technique that provides these predictions accurately, the dynamic pricing system is able to self-manage itself to avoid having to close sales in high demand contexts. In contrast, the system should choose to increase the price at the right time.

Stay restrictions

Stays restrictions consist of partial sales closures. More specifically, they are closures based on different dimensions or variables. These types of sales restrictions are common in sectors such as the hotel industry. A common example of stay restrictions would be to accept bookings based on:

- Minimum number of days of stay

- Sales channels

- Room types

- Regimes

- Check-in day (in order to avoid collapses at reception, reservations are restricted for which check-in occurs on these peak days).

The sales closures discussed in the previous point are also, in essence, stay restrictions. However, I have chosen to separate them out because they are an extreme case of stay restrictions whose effect on revenue can be devastating.

Again, these restrictions prevent bookings from entering that are willing to pay a highly competitive price. An example will make it easier to understand. Suppose the hotel sells rooms for a one-day stay at €100 and the market is responding well. The revenue manager, in order to maximise long-stay sales, imposes a restriction that only bookings of a minimum of three nights will be accepted, that is, a minimum total revenue of €300.

The question is, why limit the entry of one-day bookings that are willing to pay €400? An optimal dynamic pricing system would use price to restrict those bookings that are less desirable in a particular context, but it would never eliminate the possibility that a potential customer could pay for a product at a high price.

Conclusion

In this article we have discussed how the details of implementing a dynamic pricing system are essential to ensure that we are applying optimal prices, in other words, those that maximise revenue. More specifically, we have seen how avoiding pricing based on available stock, sales closures and stay restrictions is a big step in dynamic pricing to manage, through price, the optimal action at any given moment.

That’s it! Visit the Algorithms category to see other related posts and learn more about the Big Data technological solutions for price optimisation that we have implemented at Damavis. See you soon!